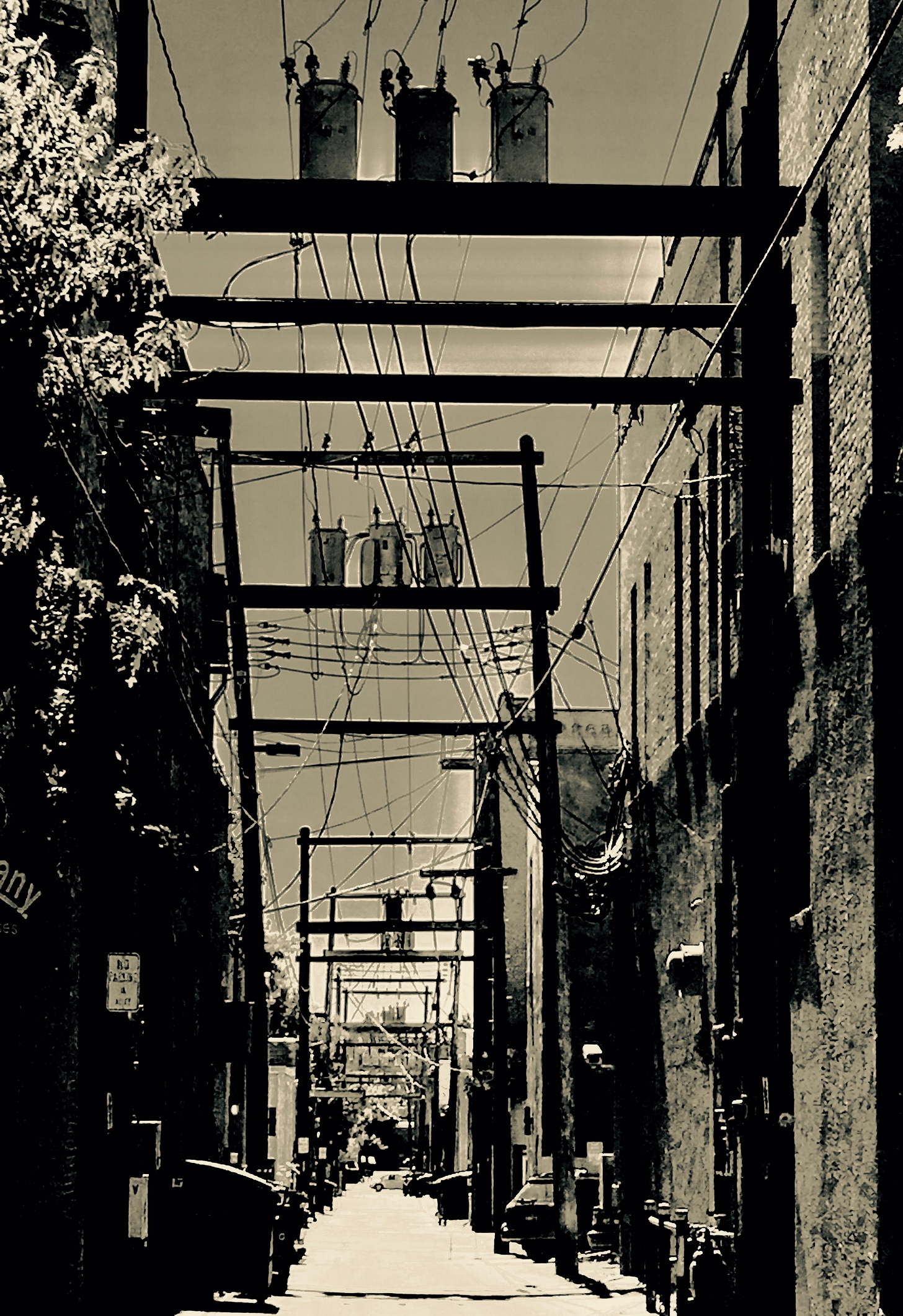

Who would plan a route through a city solely using alleys? Inefficient, filled with obstacles, and dangerous at every crossing point. Particularly insane if tolls were required at every intersection. A foolish and expensive choice, when arterials and streets designed for efficient travel are easily accessible and are funded as infrastructure. So why has the US healthcare system devolved into an equivalent labyrinth of inefficient, expensive, and in some ways dangerous routes as the only way that we can navigate our way to care as consumers, and frustrates those who are doing their best to give care? Why have policy makers let the healthcare industry determine the route we’re on, and how can we as a nation find our way out of this dead end trajectory.

Even before the COVID-19 pandemic health care policy has remained a central topic within the scope of urgent priorities we must address as a nation. Ideologically both major political parties are widely divided over the issue as to whether the government should now grab the reins from the individual. Conservatives claim this would take the nation towards a frightening new frontier with restricted choices, rationed care, and at a cost that is unaffordable. Reasonable concerns, but in reality the barn is empty and the horse is well down the road. Government in fact is embedded in our healthcare. In 2023 medicare, medicaid, veterans care (VA), and state run or administered programs accounted for 65% of all health care expenditures in the US. The remaining 35% of private sector expenditures are hardly independent of regulatory control. Health care inflation since 2000 has exceeded the CPI for the same period by 35%. In 2023 4.8 trillion dollars was spent on health care in the United States. The projected annual rate of healthcare inflation is 5.4% through 2028, approaching 18% of GDP. The evidence to follow suggests rather than protecting the consumer, the structure and funding of our health care system has impeded access, and inflated the cost of health care. Influenced by the hospital, insurance and pharmaceutical lobbies our delivery system has contributed to health care inflation that is unsustainable. The Affordable Care Act rather than reducing costs and expanding access has in fact contributed to this inflationary cycle.

We should have confidence our healthcare system gives consumers quality, choice, and cost transparency. Evidence based care is core to the care decisions made on our behalf. As efficiency and cost control under corporate healthcare has become the driving force in how we do health care we must restore the value inherent in the relational aspect of caring for patients that is the basis for advocacy and trust both patient and physician long for. Reforms including the Affordable Care Act have failed in this regard. Compounding these failures are the institutional incentives which support a linear relationship between pricing of healthcare services and provider reimbursement. The result is an economic framework that creates a bias towards expensive therapies and away from treatment that may have a lower cost but similar outcome. As an example, studies have shown this trend in the use of interventional procedures in cardiology. While more expensive than medication, interventional technologies do not necessarily result in better outcomes in certain patient groups. Similarly other sectors of healthcare goods and services suffer the same bias.

Consider the marketing and wholesale price incentives built into how Pharma markets product. Within a therapeutic class expensive drugs are emphasized when lower cost medications have equal efficacy. Equivalent and cheaper drugs are not available under many pharmacy benefit plans due to the artificial pricing and rebates negotiated by Pharma for their proprietary products. As an example, the insurance industry has used regulations requiring 80% of premiums be spent on direct care costs to enhance profits through acquiring pharmacy benefit management companies (PBM) which control health plan drug formularies. These formularies often only offer higher tier, more expensive drugs which the PBM buys at a significantly lower price point. This leaves the consumer paying out of pocket costs that are higher than necessary, and the portion the insurance company pays the PBM (which they own) towards these drugs actually returns as profit indirectly to the company. These payments for “direct care costs” pass through the PBM back to the insurance company’s bottom line. For the pharmaceutical companies efforts, lobbying of the FDA for restrictive patent laws and regulations has created incentives benefiting manufacturers such that pharmaceutical pricing in the US is significantly higher for the same drugs produced by the same manufacturers compared to pricing in other first world countries.

Insurance contracts between insurance companies and providers of services have resulted in highly variable pricing, and prohibitive out of pocket costs to the consumer. Why should a procedure or service be valued differently due to your insurance coverage, and your out of pocket cost be higher solely based on your health plan? More importantly, what barriers to accessing the “best” care are influenced by your insurance carrier? Finally, do the 8 insurance companies which control 50% of health insurance in the US constitute a manipulated market, and a violation of the intent of antitrust law?

The healthcare industry’s influence on the regulatory environment has created barriers to access as a consequence of regional market dominance, non competitive pricing, high deductibles and limited provider networks. Shrinking options for insurance and restricted provider networks have resulted in expensive care that is not equally available. Those demographics most impacted are the poor and those living in rural areas. The truth is we do have government run health care that is heavily influenced by the healthcare industry, and the reality is that this care is expensive and not equally accessible. In other words, the US has rationed care at an exorbitant price.

The COVID pandemic layered upon these embedded and systemic flaws has pushed our nation closer to the edge. Is this situation impossible to fix? In fact, we can have a private market that brings better value, and includes a place at the table for all parties currently involved in health care. We should look to other countries where there is a wealth of data regarding cost and outcomes for most major diseases and chronic illness that consume the bulk of our care dollar. Leverage this information to our best advantage as we revamp our own system from a manipulated market to one which provides quality, choice, accessibility, and is affordable.

Where do we start? Consider price caps, and reducing administrative costs currently estimated at 1 trillion dollars annually. In the hospital sector 40% of expenditures are unrelated to patient care. There are benchmarks throughout the world supporting lower costs while achieving equal or better outcomes. Other countries spend well below the U.S. as a percentage of GDP. While they pay a higher tax rate to fund health care the individual lifetime financial risk is eliminated, and the “cradle to grave” per capita expense is reduced. The benefit of our lower tax rate disappears when you look at the aggregate lifetime cost of insurance premiums, deductibles, and out of pocket expenses paid individually. A gallup survey In 2018 polled Americans regarding personal health care spending. As a nation we borrowed 88 billion dollars to pay for out of pocket health care costs, and this is after the ACA was fully implemented. Estimates are that 41% of US households carry medical debt. The Kaiser foundation reports in 2023 that employer health plan premiums for family coverage costs $23,968 annually, of which the employee premium share is $6500. The annual premium for these plans has increased 22% since 2018. In addition to premiums most plans impart first dollar costs to the patient through co-insurance, high deductibles, and out of network balance billing. Unlike in network services, out of network services can have no annual cap on individual financial risk. Exclusive of insurance premiums, average per capita annual out of pocket health expenditures average 10% of income and rises to 15% over the age of 65. The erosion of the health care dollar has only accelerated with the Affordable Care Act and expansion of medicaid. The ACA promised accessible and more affordable health care. In reality we have a shell game of cost shifting. Tax credits to subsidize ACA plans and fund medicaid are passed on to the consumer through additional taxes, exponentially increasing health insurance premiums, and rising co pays and deductibles. Hospital charges, including out of network and ambulatory facility fees are out of control. While the ACA has created the illusion of equitable access to health care we are seeing insurance companies leave markets and provider networks shrinking. Under these plans, which in some cases include medicaid, patients are finding that many providers are excluded from insurance contracts or the deductibles are so high patients can't afford to seek care. The regulatory environment creates not only perverse incentives both in drug and service pricing, but imposes a burden on physicians and other providers who struggle with mandates directed at pay for performance, expensive electronic health record software, and ever higher hurdles to be reimbursed, while incurring extraordinary costs to achieve those benchmarks. Currently 75% of primary care providers time is spent in documentation and administrative functions with only 25% spent in direct patient contact. Physicians feel trapped. Autonomy and relationship in how we treat our patients is at a crisis level with up to 40% of physicians across all specialties considering career changes out of clinical medicine, or withdrawing to part time practice. We are seeing a progressive rationing of care through attrition of providers leaving medicine. Independent practices are not sustainable and are being acquired (not purchased) with consolidation of those services under the umbrella of large integrated health care systems. Those systems which are largely hospital based, will choose which markets to continue operating in, and it won't be those which are marginal now. Fewer remaining independent physicians will reach compliance under industry and federal regulations. To avoid economic and regulatory penalties increasing numbers of these providers (who are more likely to have rural practices) will opt out of both CMS/Medicaid, and third party insurer contracts. As a patient, It won't matter that you have an insurance card in your wallet--there is an ever greater chance you won't find a provider who is able to care for you due to closed panels, even if they are enrolled as a contracted provider. As a consumer the care you access will be out of network, and your first dollar responsibility will be crushing.

For those that push back against change I have to ask the question: How can you like your health insurance when it has the potential to bankrupt you?

If we don’t move away from business as usual it is more than an inconvenience. We already see the impact it has had on our public health. It is clear that the lack of availability and higher cost of services in rural and economically depressed areas correlates with worse outcomes and a lower lifespan for rural and urban poor Americans. The status quo in health care threatens our economy, and consumes resources that could be redirected towards programs that improve educational performance and stimulate economic growth leading to upward social mobility. Decisions regarding health care policy are as crucial to our national security and well being as any decisions regarding defense or foreign policy.

Congress and the executive branch of government should know that core to leadership is understanding what you don’t know, followed by cultivating resources which bridge that gap and bring informed ideas into the discussion. We are fortunate that some of the brightest minds in health care policy, economics, and delivery systems are right here in the US. Congress would do well to turn their collective ear away from industry lobbyists and start listening to a different voice. I’m not an economist, nor do I have a background in policy, but I do have almost 40 years as a primary care internist witnessing the impact our health care system has had on my patients and my colleagues. Let me emphasize this—America has the best technology and the best talent in healthcare anywhere. Where we fail is the structure by which we pay for and access care. Innovation in delivery systems and a new regulatory environment are critical to change. Any plan that evolves out of our current mess will be an evolution of ideas, but what follows are some thoughts to consider:

*Institute graduated caps on fees for health related goods and services including pharmaceuticals, hospital based care, and ancillary services. In the same way restructure the health insurance industry regarding premiums and the multiplicity of in versus out of network contracts that are particularly costly to consumers. The industry already contracts with medicare and medicaid at a lower price point. Let the entire market compete down from caps based on a free, rather than manipulated marked regarding the pricing of goods and services in healthcare. In time health care cost and inflation will more closely align with the CPI as the industry becomes efficient and accountable.

*Expand access and streamline primary care delivery by eliminating fee for service reimbursement. As an alternative consider funding primary care through capitation. This is a payment system where providers receive a global fee per person monthly for each individual enrolled in their panel of patients. Capitation would fund both provider overhead and income while reducing administrative costs through eliminating fee for service billing. Capitation would be limited to only out patient services in the primary care setting. All other services would be billed through insurance. In the private sector capitation through direct primary care practices is already growing in popularity at lower costs and improved patient and provider satisfaction while insurance covers the risk for extended care costs.

*Expand the use of health savings accounts to cover deductibles, co- pays, and out of pocket costs. Health insurance premiums would be paid with pre-tax dollars. For the employed, these would be paid through a payroll deduction. Insurance for those qualifying under medicaid would still be federally funded and administered at the state level. In addition to current funding for medicaid we should consider supplemental funding through issuing federal or state health care bonds. This would create an investment market while reducing the tax burden on individuals and businesses. Bond interest paid would be offset through reductions in administrative costs as we streamline and reform the current regulatory environment.

* Insurance requires a shared risk pool to function. Everyone should participate, and everyone’s coverage should be robust and inclusive. Uniform coverage would eliminate many of the barriers to care that result from “cherry picking” by health care organizations that preferentially build patient panels based on insurance plans that have the highest reimbursements. Plans that level access would continue to be brokered by insurance companies through the private market. Uniform coverage would reduce administrative costs while maintaining a margin that supports private sector participation. A major area of reform should include restructuring of federal medicare policy. Eliminate inefficient regulations that currently do not improve outcomes and distract providers from caring for patients. Patients should be the focus, not navigating the electronic health record for compliance reasons.

The government can and should provide regulatory oversight of a competitive market brokered by the insurance industry. Socialism you say? Hardly—We don’t individually negotiate for fire protection, police, or roads. Private utilities operate as regulated business regarding services and pricing. We would be shocked if it was required we individually negotiate and contract for payment of public infrastructure. Like our road and highway system, infrastructure is used by all, necessary for a functioning society, and contributes to economic stability and growth. Healthcare defined in this way is indeed infrastructure and aligns itself to a regulatory framework similar to other infrastructure. It is time to get out of the alley.

While policy is the realm of policy makers, and we should insist on accountability, our first responsibility is taking charge of our own health. Make choices that promote health. Lifestyle interventions are inexpensive and have a profound impact on reducing healthcare costs, and leading a happier and more productive life. The challenge of health care is more than a balance sheet. It begins with each of us, and the understanding that our individual choices impact all.